The Mandatory Provident Fund (MPF) is a crucial retirement savings scheme in Hong Kong. It was introduced in December 2000 to ensure that employees and self-employed individuals save for their retirement 員工福利. Managed by the Mandatory Provident Fund Schemes Authority (MPFA), MPF helps build long-term financial security. This article explores MPF contributions, benefits, investment options, and withdrawal rules.

Understanding MPF Contributions

Employer and Employee Contributions

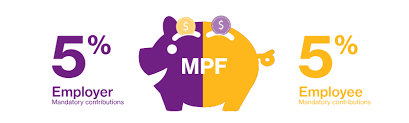

Both employers and employees are required to contribute to MPF. Here’s how it works:

- Employers contribute 5% of the employee’s monthly salary.

- Employees also contribute 5% unless their salary is below HKD 7,100, in which case only the employer contributes.

- The maximum relevant income for MPF contributions is HKD 30,000, meaning the highest mandatory contribution is HKD 1,500 from both employer and employee.

Contributions for Self-Employed Individuals

Self-employed individuals must contribute 5% of their assessable income, with the option to pay monthly or annually.

MPF Investment Choices

MPF contributions are invested in different funds to grow savings over time. Employees can choose from the following options:

- Equity Funds – Invested mainly in stocks, offering high returns but with higher risks.

- Bond Funds – Focused on fixed-income securities with lower risks and stable returns.

- Balanced Funds – A combination of equities and bonds, balancing risk and reward.

- Conservative Funds – Low-risk funds that aim for stable but modest growth.

- Default Investment Strategy (DIS) – A simplified investment approach that adjusts risk levels based on age.

Key Benefits of MPF

- Secured Retirement – Ensures employees have savings after retirement.

- Employer Contributions – Employers are required to contribute, increasing total savings.

- Tax Deduction – Employees can enjoy tax benefits on their contributions.

- Investment Flexibility – Employees can choose investment options that match their risk tolerance.

- Portability – Employees can transfer their MPF funds when changing jobs.

MPF Withdrawal Conditions

MPF savings are typically accessible at age 65, but early withdrawal is permitted under specific conditions:

- Permanent departure from Hong Kong

- Early retirement at age 60

- Severe illness or permanent disability

- Death (funds are given to beneficiaries)

Conclusion

MPF is an essential retirement savings system that benefits employees and self-employed individuals in Hong Kong. By understanding its contribution rules, investment options, and withdrawal conditions, individuals can make the most of their MPF savings. Planning ahead and making informed investment choices can help ensure a financially stable retirement.